With the availability of so many life insurance companies, choosing the right insurance company for you and your family can be a bit difficult. You have to be very careful while comparing different companies on several performance parameters to make a sound decision.

To simplify the comparison process for you, we at PolicyX.com have defined key functions like Annualized Premium, Claim Settlement Ratio, Solvency Ratio, etc. which should be considered while selecting a company. Must refer to the IRDAI Annual Report to examine the performance data of the insurer to determine the credibility and financial soundness of the insurance company.

Take a look at the key features of SBI Life Insurance Company which will give you a clear picture and help you find the answer

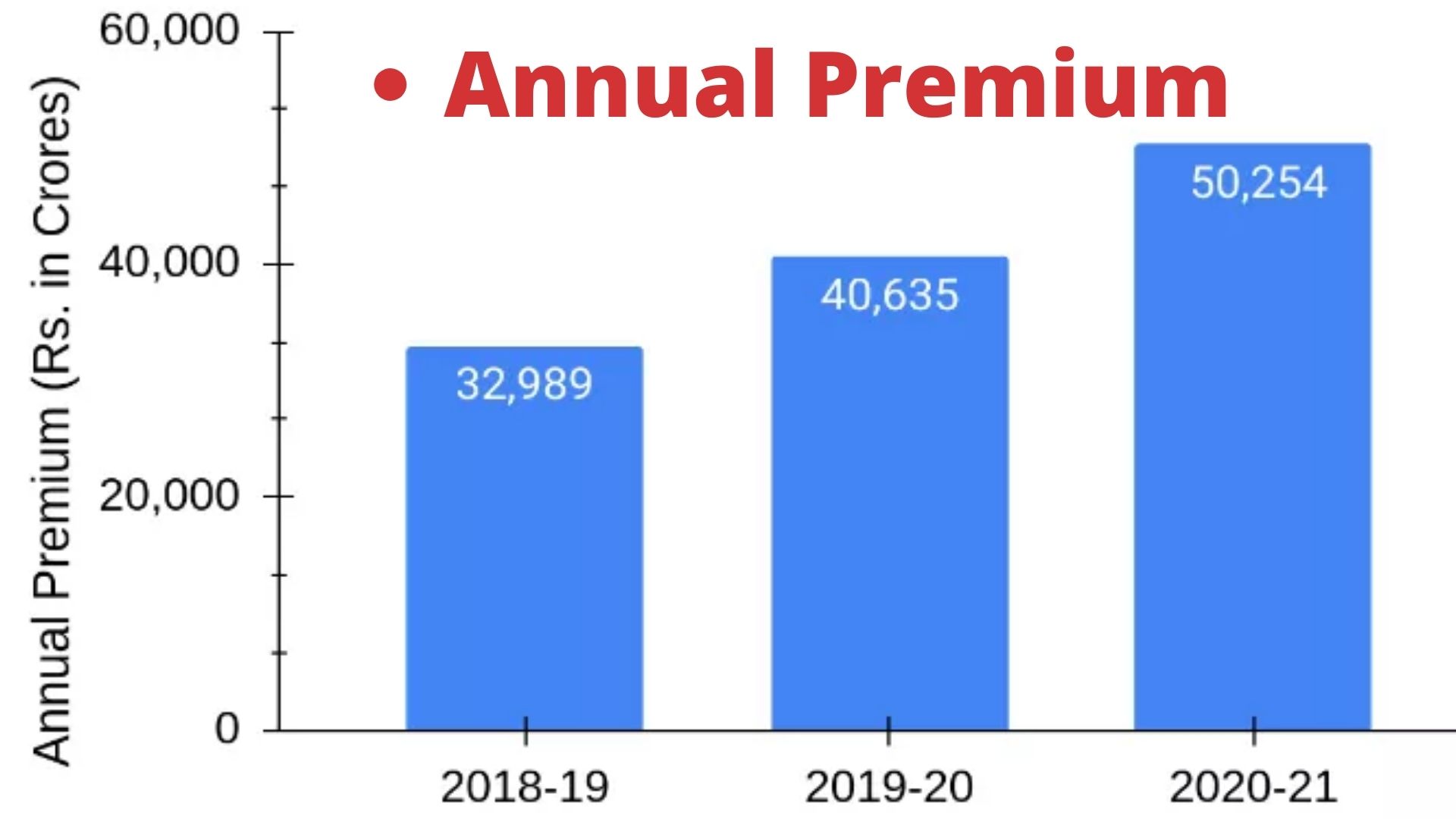

1. Annual premium

With a wide range of life insurance products, the company caters to the needs of every individual from every walk of life. As per the IRDAI report 2020-21, SBI Life Insurance has increased the annual premium to Rs. 50,254.17 crores.

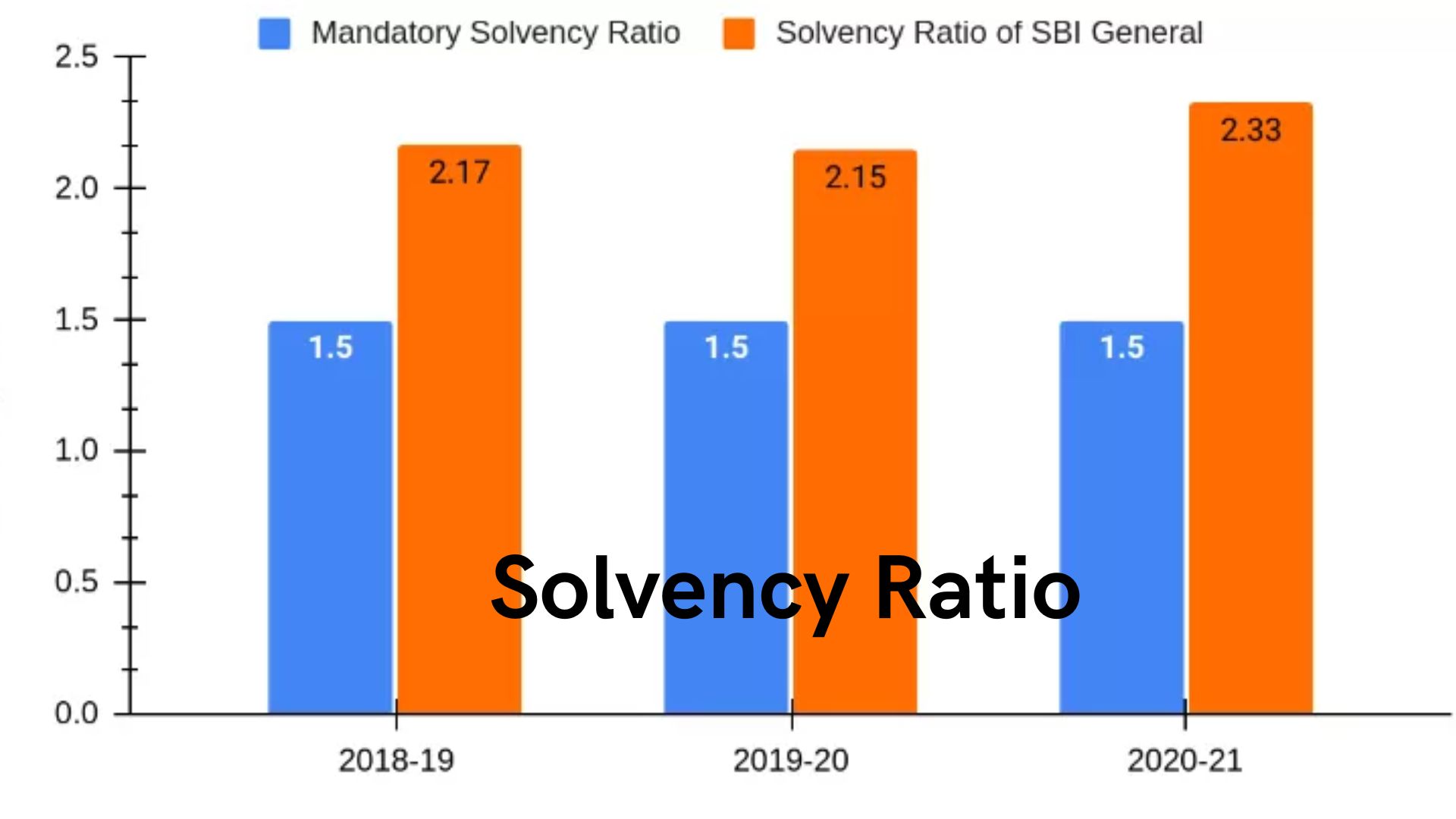

2. Solvency Ratio

As per the insurance experts, the solvency ratio of the company helps an individual ascertain the company’s ability to meet its long-term financial obligations.

It has now been mandated by the IRDAI for every life insurer to maintain a solvency ratio of 1.5.

The solvency ratio of SBI Life Insurance company for 2020-21 is 2.33.

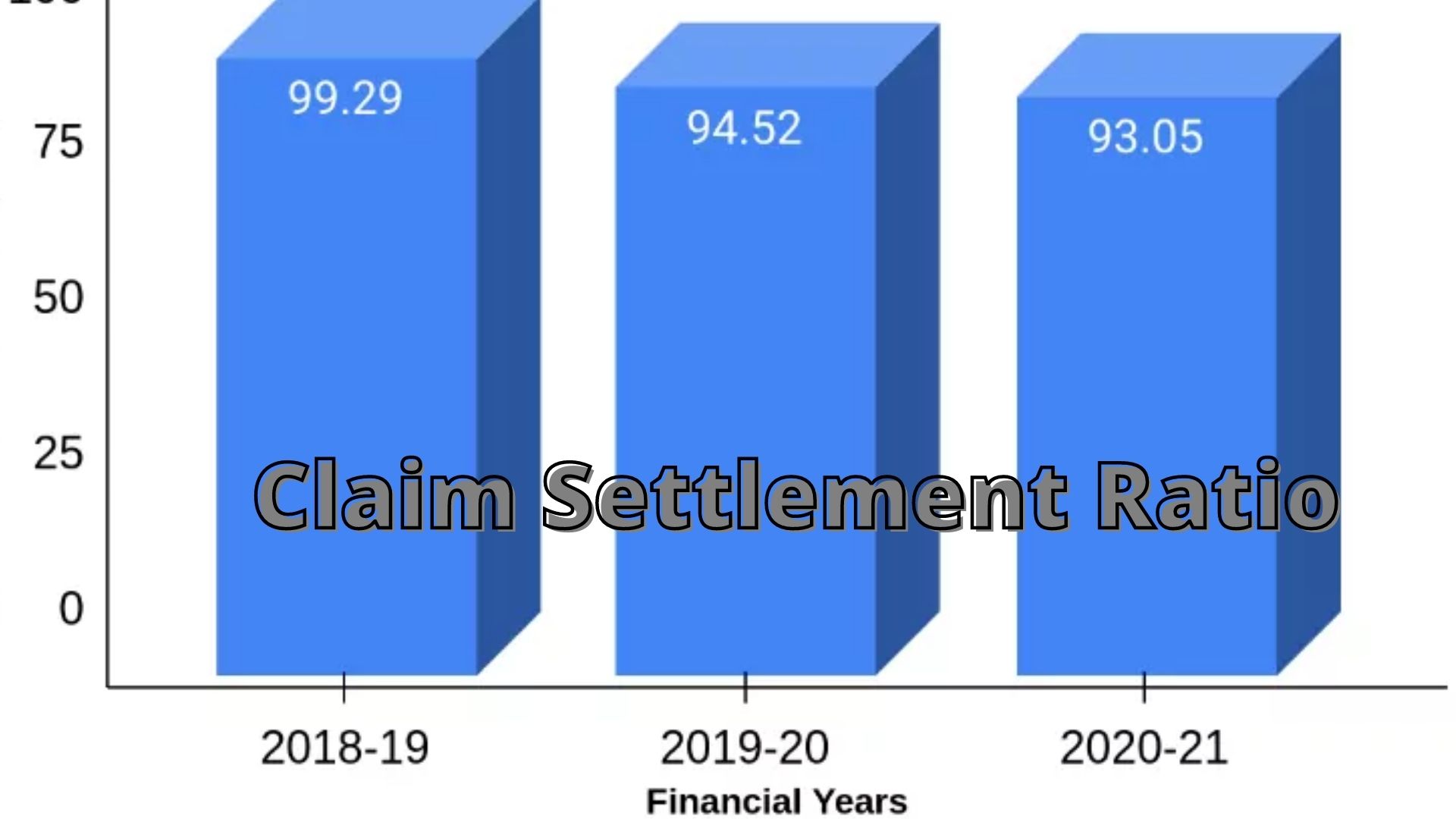

3 .Claim settlement ratio

How good is your life insurance if you or your family does not get it in times of need? Therefore, it is important to choose an insurance company that has a good Claim Settlement Ratio (CSR) as a higher ratio indicates better claim credibility of the company.

As per the IRDAI report for 2020-21, SBI Life Insurance had a claim settlement ratio of 93.05, which clearly indicates how dedicated the company takes to ensure that you or your family members do not face any difficulty in getting their claims. Don’t have to go through trouble.

Operating network

What distinguishes SBI Life Insurance is that the company works with 947 offices across the country, 17,464 employees, a large and productive individual agent network of approximately 170,096 agents, 57 corporate agents and 28000+ partner branches and other insurance marketing firms. Is.

Different Types of SBI Life Insurance Plans

SBI has carefully designed 25+ life insurance plans to meet the diverse needs of an individual and their family. SBI Life Insurance plans are designed in such a way that they ensure that all your insurance needs are met. From protection plans to child plans, retirement plans to savings plans, SBI strives to provide support for every aspect of your life.

Go through this table to find out all the SBI Life Insurance plans offered by the company under various categories

| Product | Name of Plan |

| Protection Plan | SBI Life Saral Jeevan Bima SBI Life Poorna Suraksha SBI Life Sampoorn Cancer Suraksha SBI Life Smart Shield SBI Life Corona Rakshak Policy SBI Life Smart Swadhan Plus SBI Life Saral Swadhan + SBI Life Grameen Bima |

| Child Plan | SBI Life Smart Champ Insurance SBI Life Smart Scholar |

| Wealth Creation With Insurance | SBI Life e Wealth Insurance SBI Life Smart InsureWealth Plus SBI Life Saral InsureWealth Plus SBI Life Smart Wealth Builder SBI Life Smart Wealth Assure SBI Life Smart Power Insurance SBI Life Smart Elite SBI Life Smart Privilege |

| Savings Plan | SBI Life Smart Platina Plus SBI Life Smart Platina Assure SBI Life New Smart Samriddhi SBI Life Smart Future Choices SBI Life Shubh Nivesh SBI Life Smart Bachat SBI Life Smart Humsafar |

| Retirement Plans | SBI Life Saral Pension SBI Life Retire Smart SBI Life Annuity Plus SBI Life Saral Retirement Saver |

| Money-Back/Income Plan | SBI Life Smart Money Back Gold SBI Life Smart Money Planner SBI Life Smart Income Protect |