Whatever vehicle you have, you must know the answer to this question that if you are in a place where there is a sudden flood and your vehicle drowns, will you get money or not? Apart from this, if the vehicle drowned in the flood is found, will the company pay for repairing it or will you have to spend money from your pocket to get your vehicle repaired?

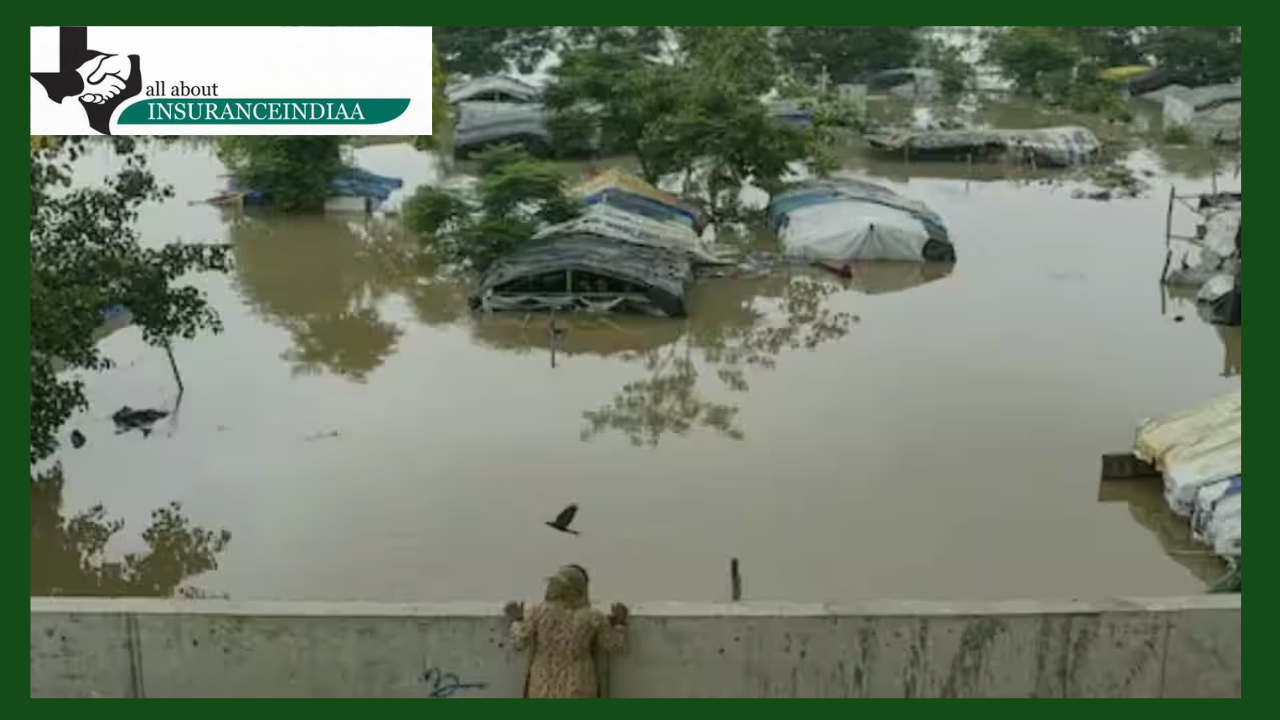

Flood-like conditions prevail in many states of the country at this time, so far many videos have surfaced in which vehicles are seen floating with the fast flow of water. Seeing such a situation, the only question that arises in the mind is will the people whose vehicles got submerged in the fast flow of water and got lost somewhere, will they get money from the insurance company? Apart from this, if we assume that a car submerged in flood water is found, will the company get the vehicle repaired or will the car owner have to spend money from his pocket?

There are many questions, today we are going to answer all these questions in detail so that the confusion going on in your mind can be removed. During a conversation with Santosh Sahani, Motor Head of Kataria Insurance, he answered five big questions.

First question: Will you get money for the car that drowned in the flood?

Answer: The answer to this question is yes, your insurance company will give you money for the car that drowned in the flood but the amount you will get is only as much as the current IDV value of your car.

Second question: Will a car submerged in a flood be repaired?

Answer: In this case, the insurance company will first look at some things like if your car is in repairable condition or not. If the car can be repaired then how much will it cost to repair it? If the cost of repairing the car is more than the current IDV value of your car, then in this case the company will declare the car a total loss and you will be given the IDV value.

If the cost of repairing is less than the IDV value, then the company will get your car repaired and give it to you. IDV value is the amount that the company gives you when your car is not in repairable condition. Let us tell you that every year the IDV value of the car falls by 10 percent.

Third question: Will money be spent from your pocket after finding a submerged car?

Answer: If by chance, your car submerged in flood is found, then also money can be spent from your pocket. You will also ask why, we have taken insurance. If you have taken Comprehensive Insurance but have not taken an add-on plan for engine cover, then in this case the company will not pay for repairing the engine and whatever cost is incurred in repairing the engine, you will have to pay from your pocket.

Fourth question: 50% money can be spent from your pocket

Answer: Apart from this, if you have not taken Zero Depreciation Policy along with Comprehensive Policy, then in this case you will have to pay up to 50 percent of the cost. If you have both Comprehensive and Zero Depreciation Policy, still you will have to pay the money to repair the engine, if you have both the policies, the company will bear the rest of the expenses in the car but due to lack of engine protection cover, you will have to bear the cost of repairing the engine.

Fifth question: Will money be spent from your pocket even in case of total loss?

Answer: If your vehicle is a total loss, in this case you will get the IDV value but you will have to pay an estimate charge of 2.5% to 5%. This charge is usually collected by the garage owner.