Senior citizens: The Union Budget 2023 has been a blockbuster for senior citizens. Schemes like Senior Citizens Savings Scheme (SCSS) and Post Office Monthly Income Scheme (POMIS) got a facelift as Finance Minister Nirmala Sitharaman decided to increase maximum investment in these state-backed schemes.

Not only this, Sitharaman also launched another scheme for women of all ages called Mahila Samman Savings Certificate (MSSC). There is already a scheme for senior citizens- Pradhan Mantri Vaya Vandana Yojana (PMVVY) is operational.

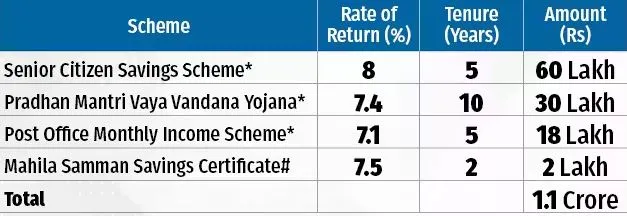

By combining all these schemes, an investment of Rs 1.1 crore will earn a senior citizen couple a monthly income of around Rs 70,500. These are assured returns. know the whole math

Get assured returns

The maximum investible amount under SCSS has been increased from Rs 15 lakh to Rs 30 lakh.

This means that a senior citizen couple can deposit up to Rs 60 lakh, if they wish to max out the quota. SCSS is available through India Post and commercial banks and has a tenure of five years.

It can be extended for three years at the time of maturity. However, like other small-savings schemes, the interest rate is reviewed every quarter. The rate offered at the time of deposit is fixed for the period. As of now, SCSS offers 8 percent rate of interest payable quarterly.

The enhanced maximum investable amount under POMIS up to Rs.9 lakhs from Rs.4.5 lakhs earlier for single holder account is also attractive. In this way a couple can invest up to Rs 18 lakh in it.

The proposed rate of interest is 7.1 per cent per annum, payable monthly for five years. POMIS, technically known as Post Office Monthly Income Scheme Account, can be availed by non-seniors also. But it is popular among senior citizens because of its monthly income payout option.

Separate scheme for women

MSSC is the new scheme here. This scheme is only for women and girls. The maximum investment limit is Rs 2 lakh and the tenure is two years. The scheme will be on the shelf till March 2025 and will offer an interest rate of 7.5 per cent. Further details are awaited.

Don’t forget the PMVVY, which allows deposits of up to Rs 15 lakh for a senior citizen. The 10-year plan, managed by Life Insurance Corporation of India, offers a return of 7.4 per cent. So a senior couple together can invest Rs 30 lakh in this.

All these four avenues would enable a senior couple to invest Rs 1.1 crore. Then such a monthly income of Rs 70,500 will be earned.