The date of default in premium of the insurance policy should not be more than 5 years old. That is, you can revive the policy within 5 years of default in the first premium payment.

LIC Lapsed Policy Revival Scheme: You have a policy of Life Insurance Corporation of India- LIC and it is running in lapsed mode. That is, if you have not paid its premium for a long time, then you can make your policy active again by paying the remaining premium.

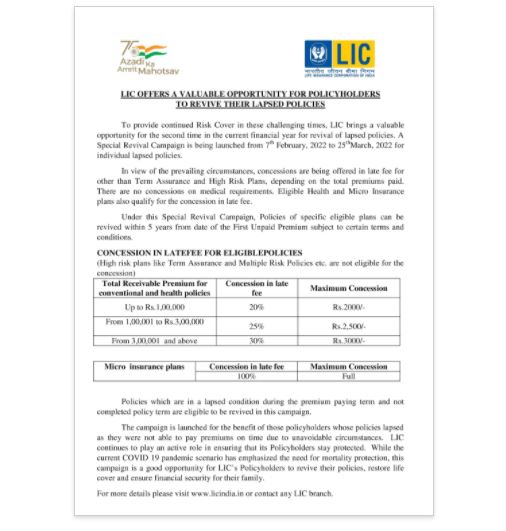

Actually, the country’s largest government insurance company Life Insurance Corporation of India (LIC) has given big relief to the policy holders on the lapsed policy.LICHas launched a campaign to get the lapsed insurance policy revived cheaply.

The campaign that started in February will end on March 25. That is, now you have only 3 days left to restart the policy. Along with this, policies whose premium date has passed but the revival date is still pending can take advantage of this campaign.

It is to be noted that multiple risk policies, term insurance policies and high risk insurance policies have not been included in this campaign.

The special thing is that to start the lapsed policy againLICIt is also giving relief to its customers. If your outstanding premium amount is up to Rs 1 lakh (including late charges), you will be given a rebate of up to Rs 2,000. A rebate of up to Rs 2500 is being given on arrears of Rs 1 lakh to Rs 3 lakh and up to Rs 3,000 on arrears above Rs 3 lakh.

The date of default in premium of the insurance policy should not be more than 5 years old. That is, you can revive the policy within 5 years of default in the first premium payment.

Late fee waiver will not be admissible in case of high risk plans like term insurance, multiple risk policies etc. Such policies, which have lapsed into the premium paying term and whose policy term has not been completed till the revival date, can be revived in this campaign.

LIC has said that this campaign has been started for those policy holders whose policies have lapsed. Because, they were not able to pay the premium on time due to some bad condition.