The new dynamic plan allows users to switch On and Off the insurance policy at the click of a button.

Kotak Mahindra General Insurance Company (Kotak General Insurance) has launched its add-on Meter (switch on/switch off) cover for Private Car insurance policy. Following the launch, it claims to become India’s first company to offer a cashback via an add-on for private car insurance policy.

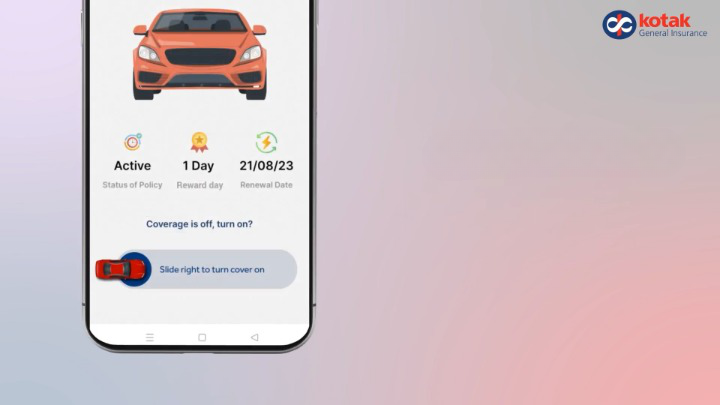

On opting for the Meter (switch-on/off) add-on, users have to download the Kotak Meter Mobile App available on Play Store or App Store, which allows the vehicle owners to switch their car insurance coverage ‘On and Off’ based on usage, at the click of a button.

The name ‘Meter’, a colloquial term associated with commuting, signifies that vehicle owners can pay for insurance only when the vehicle is in use. Through a simple switch on and off feature on the mobile application, customers are awarded a reward day for every continuous 24 hours, the cover is turned off, when the vehicle is not in use. Accumulated reward days can be redeemed either by getting discount in renewal or cashback, upto 40% of Own Damage (OD) premium at the end of the policy term.

Suresh Agarwal, MD and CEO, Kotak General Insurance Company said, “Demand for need based insurance cover has been on a rise particularly post Covid. With hybrid and work from home policies coupled with higher fuel prices and increasing inflation has witnessed a change in driving preferences by most vehicle owners.”

“This drove us to bring out a customer-friendly Switch On and Off feature as an add-on on our car insurance policy. With the new tech-enabled insurance policy ‘Meter’ we want to treat all customers fairly and reward those customers who drive less. This we think will help in customer retention as well as help understand and serve our customers better following their driving behaviour,” he added.