This time from the budget, the insurance sector is expecting that the amount received on maturity of life insurance should once again be brought under the ambit of tax free. Besides, a request is also being made to extend the benefits of NPS to life insurance annuity plans.

People receiving returns from life insurance got a big blow in last year’s budget. The government had removed the tax free status of returns from traditional endowment policies.

Such life insurance policies which provide a lump sum amount as return are called endowment policies. The Central Government had excluded from the ambit of tax free such endowment policies whose annual premium is more than Rs 5 lakh.

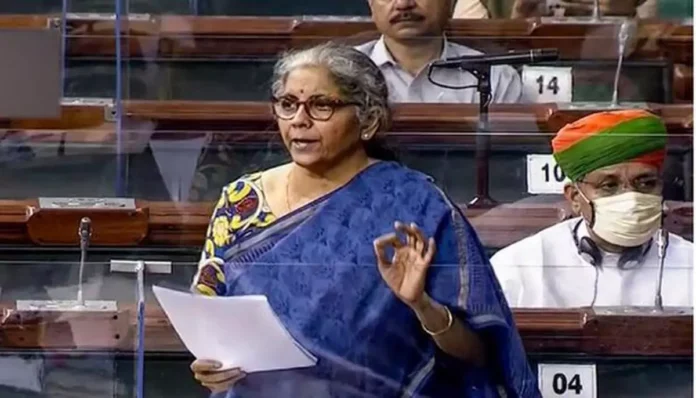

Experts in the life insurance sector believe that no such step will probably be taken in this budget. Apart from this, the insurance industry is also hoping that the limit of tax free annual premium should also be increased. However, Finance Minister Nirmala Sitharaman has made it clear that no major changes will be made in the budget.

The life insurance industry was dealt a blow in the budget 2023 by changes in the tax free range . This time the industry is hoping that even if the life insurance policy is not given tax free status back, the premium limit should be increased. Currently, tax is being levied on the maturity benefit received from policies with annual premium up to Rs 5 lakh.

It is expected that this limit will be increased to Rs 10 lakh. Sumit Rai, MD and CEO of Edelweiss Tokyo Life Insurance, says, “The insurance industry is requesting the government to increase the limit of Rs 5 lakh to Rs 10 lakh. It is possible that we may see some changes in this regard.”

Extension of NPS benefits:

The industry is also hoping that the tax benefits of NPS should also be extended to the pension policies offered by insurance companies. This can help in increasing pension coverage. Let us tell you that under 80C, apart from the overall exemption of up to Rs 1.5 lakh, an additional exemption of up to Rs 50,000 is available on NPS investment.

Tax Free Annuity Income

Life insurance industries are hoping that the annuity given to retired people should be taken out of the tax net. This will not only provide relief to retired people but will also help the pension sector.