Income Tax slabs, rates and exemptions for senior citizens: The basic tax exemption limit for retired employees falling between the age of 60 to 80 years is Rs 3 lakh. In the case of very senior citizens (above 80 years), the exemption limit is Rs.5 lakh.

Income Tax slabs, rates and exemptions for senior citizens: Salaried and pensioners have to mandatorily file their income tax return (income tax return-ITR). However, in the Budget 2021-22, the government added a new section in the Income Tax Act, 1961, wherein senior citizens above the age of 75 are not required to file ITR if they meet certain criteria. We will tell you about the income tax of senior citizens, rates and exemptions that they get.

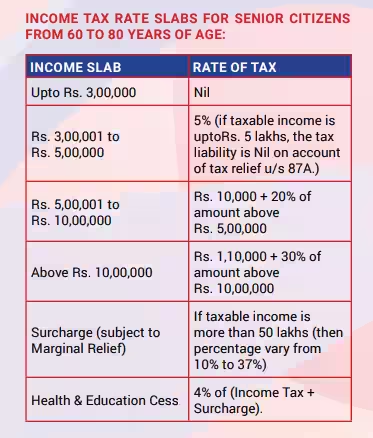

Income Tax Slab for Senior Citizens (60 to 80 Years)

Income tax slab for senior citizens above 80 years

Income tax exemption limit for senior citizens

Senior citizens are those people who are 60 years or more or less than 80 years of age till the last financial year. The basic tax exemption limit for retired employees falling between the age of 60 to 80 years is Rs 3 lakh. In the case of very senior citizens (above 80 years), the exemption limit is Rs.5 lakh.

Is pension taxable in India?

Pension received by retired employees is taxable. This is taxable as income under the head ‘Salaries’ after the exemption limit.

Tax on gratuity and provident fund of retired employees?

For government employees, the amount received from EPF is tax free. EPF is tax exempt for non-government employees, but only if the withdrawal is made after 5 years of continuous service. Also, for this, EPF should be from a company which is registered with EPFO.

Gratuity received on retirement is tax free for government employees. Whereas, for non-government employees, gratuity is tax free only in select situations.

Gratuity amount of Rs 10 lakh

Salary for 15 days of service every year

Actual gratuity has been received.

Is family pension taxable?

Family Pension is taxable in India. This is taxed under the head ‘Income from other sources’. Deduction is available on this up to 33.33% or Rs 15000 (whichever is less). Only after that it can be taxed.