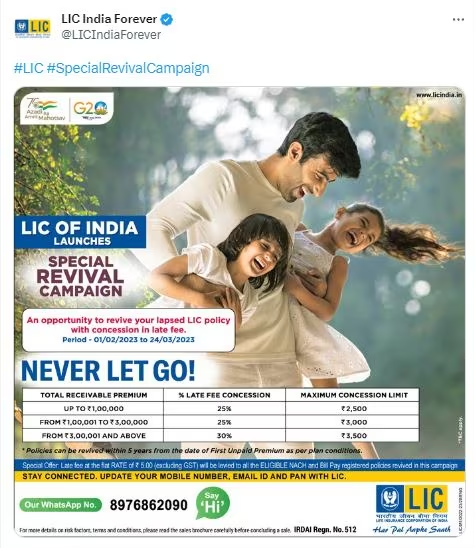

Has started ‘LIC Special Revival Campaign’. This campaign will run till 24 March 2023. In this, a big discount is being given on the late fee charged on the premium.

LIC Special Revival Campaign: Crores of people in the country are policy holders of Life Insurance Corporation of India (LIC Policy Holders) . Giving great relief to these crores of its insured, LIC is giving a chance to restart the policy which has been closed for years. The special thing is that a big discount is also being given on the penalty imposed on the policy premium. In such a situation, if you also have a policy of LIC, which has lapsed, then you can get it started again in a special campaign of LIC.

In fact, Life Insurance Corporation of India has started ‘LIC Special Revival Campaign’ to revive lapsed policies . This campaign will run till 24 March 2023. In this, a big discount is being given on the late fee charged on the premium. Let us know how you can start your policy through this special campaign.

The policy which has been closed for 5 years can be started again. The

special thing is that LIC is giving a chance to restart the policy which has been closed for 5 years in ‘Special Revival Campaign’. Normally lapsed policies are not revived for such a long interval. However, LIC will allow revival of policies which have been lapsed for 5 years only as per the policy conditions.

Up to 30 percent discount on late fee

On the other hand, up to 30 percent discount will be available on the late fee charged along with the premium on the closed policy. However, the maximum concession will be up to Rs.3500. You can take help of LIC’s interactive service for more details and terms and conditions regarding this special revival campaign. LIC’s policy holders can send ‘Hi’ on WhatsApp from their mobile to 8976862090. This campaign has started from February 1 and will run till March 24.

Whenever you buy an insurance policy, you have to pay the premium on time to avail the benefits available in it. Many times the policy lapses due to delay in depositing the premium. With this the risk cover of the life insured ends. In such a situation, if a claim comes, the insurance company does not accept it, so it is necessary that the premium is paid regularly.