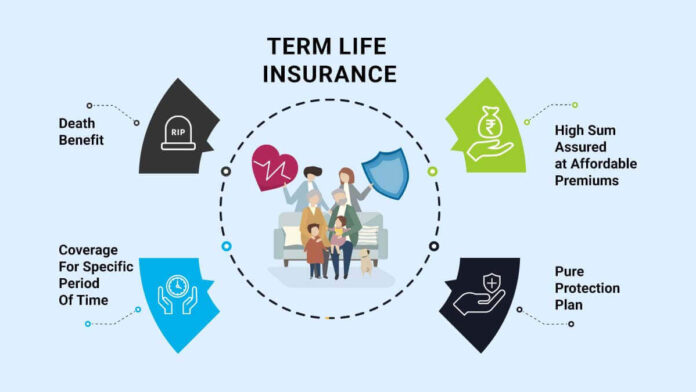

Everyone has understood the importance of term life insurance, especially after Corona. It is important to create a secure future not only for yourself but also for your loved ones. While taking term life insurance, you can make the claim settlement process easier by keeping certain things in mind.

Twitter Facebook

Buying term life insurance is an important decision. Especially since Corona, people have become more aware about a safe tomorrow. A term life insurance not only provides you with a lump-sum amount at the time of need and after the maturity period but also secures the future of your loved ones. The fund of term life insurance is simple, that means you pay the premium and you get the life cover. But before buying life insurance, you can take care of some special things.

1. Buying Adequate Cover

It is important to select a cover in which you get enough facilities. However, the selection of the cover of the right amount is also necessary. Before choosing a cover, you should take care of all the things like your monthly expense, earnings, age, medical history. Many times we do not select a plan with adequate facilities due to taking a low budget plan. In such a situation, this coverage will not be beneficial for you in the long term.

2. Decide the duration of the term plan

If you want plans with coverage against more diseases for less money, then you can take an insurance plan in early age. Younger people have to pay lower premiums for term insurance plans.

3. Don’t Hide Information

If you want to get the most out of your policy, do not hide any information from your insurer. If you smoke or are an acute drinker or are suffering from any kind of disease, then definitely share such information with the provider. With this, your provider will ensure that your claim is not rejected in the future.

4. Select Additional Riders as per the requirement

Additional rider i.e., extra benefits. Whose charges you have to pay, but when you add them with full information, then they are very useful for you. You can add some additional riders such as Accidental Death Benefit, Total and Permanent Disability Protection, Riders like Child Support Benefit.

5. Select the Right Insurance Provider

Apart from all these things, it is very important to choose the right insurance provider. It is very important to know how quickly your chosen provider settles the claim. Therefore, before taking a policy, definitely take information about this.